Income Duty Returns( ITR) form deadline passed How to file duty now, what's the fine and other details

July 31 was the last date to file IT Returns( ITR) for the financial time 2021- 2022( FY-2021-2022). nearly in a first, the government this time didn't extend the last date of filing the ITR. For numerous times, the last date has been extended till October 31 or December 31. Though this time there has been no extension, this doesn't mean that taxpayers who missed the deadline can not file their ITR now. They can till December 31, but yes will have to pay a penalty. The process of form ITR remains the same, there's no change in this. So, then’s a step- by- step companion to help you guide through form of IT returns online and how important forfeiture you'll have to pay.

1. Penalty figure of Rs,000 to be applicable if the total income is above Rs 5 lakh

As per the section 234F of Income- duty Act, when a person needed to furnish a return of income under section 139 after the due date, will be charged a sum of Rs,000 as penalty.

2. Penalty figure of Rs,000 to be applicable if the total income does is lower than Rs 5 lakh

handed that if the total income of the person doesn't exceed Rs 5 lakh, the figure outstanding under this section shall not exceed Rs,000.

3. Physical verification of the ITR calculation needs to done within 30 days of filing the ITR, it was before 120 days

Central Board of Direct levies( CBDT) so far gave 120 days for physical verification of income duty return( ITR). Now this physical verification time limit has been reduced to 30 days for ITR filed online.

4. Individual taxpayers have 5 months to file their ITR( with penalty)

Central Board of Direct levies( CBDT) has set the time for filing delinquent ITR to December 31, 2022.

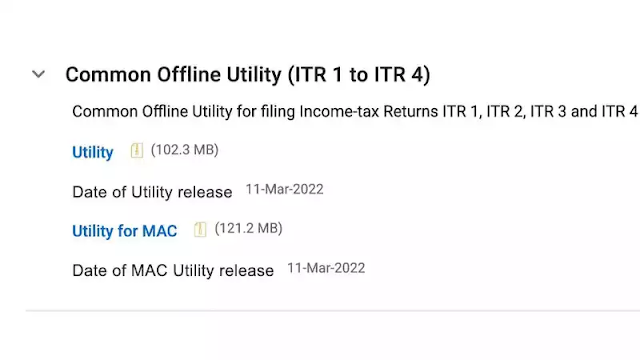

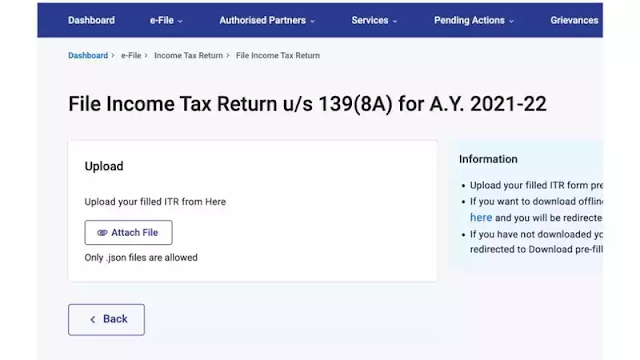

5. Download ITR form and fill it using offline mileage

Before pacing with the way, you ’ll need to fill in all the necessary details in the ITR form using the offline mileage tool handed by the gate. You can click then to download the tool.

Once the form is filled and ready, download it. You'll get a train in ‘. json ’ format.

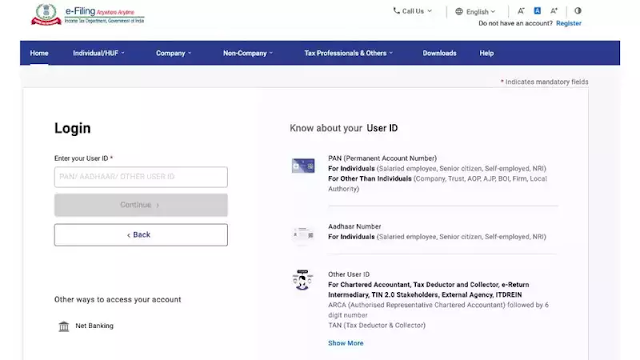

6. Open Income Taxe-Filing portal

Head to https//eportal.incometax.gov.in/ iec/ foservices/#/ login using any web cybersurfer on your laptop

7. Login using the right credentials

To pierce the Income duty Returns form, you ’ll need to login into your account. At the login runner, enter your stoner name( visage number, Aadhaar number) and word. Alternately, you can also use your bank’s Net Banking credentials to login through the bank gate. Just note that once you ’ve logged into your Net Banking account, it'll automatically deflect you to the Income duty website.

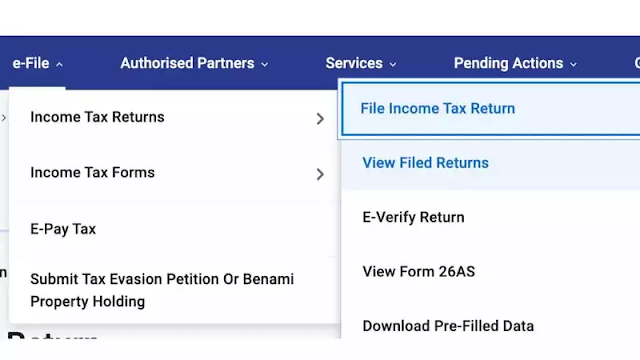

8. Head to ‘ train your income duty return ’ runner

Formerly logged in, click one-File menu at the top and hang your mouse on ‘ Income duty Returns ’ option and also click on ‘ train Income duty Return ’ option from the dropdown.

9. Fill in introductory details on Income duty Return runner

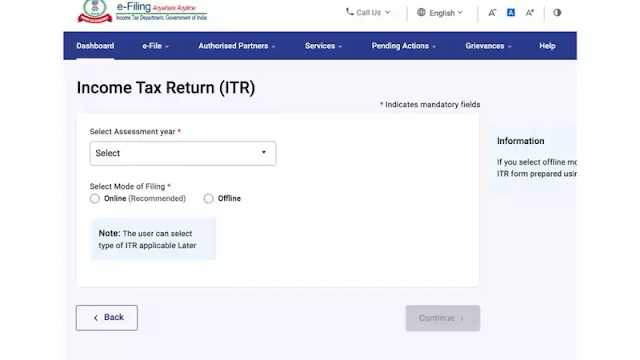

A new Income duty Return runner will open, then enter Assessment Year, Filing Type and ITR Type and hit Continue.

10. Upload your ITR form

As mentioned, you ’ll need to fill the ITR form and keep it ready before pacing with these way. Simply click on Attach then button and upload your form. Do note that only. json lines are allowed.

No comments:

Post a Comment